2Q23 Advertising: Digital Up, TV Down. Industry Solid And Positioned to Improve

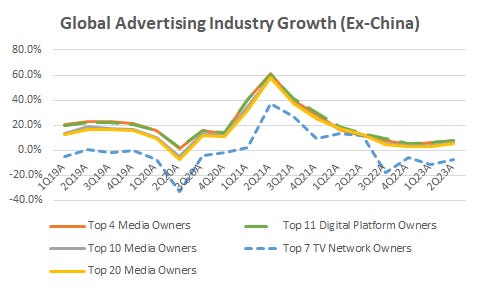

After a week of travelling I’ve caught up on the remainder of major companies’ reporting of financial results for the second quarter of 2023. As I anticipated, the world’s 20 largest sellers of advertising outside of China (covering 70% of the industry) posted growth above 5% (5.3% to be precise) in organic terms, ahead of the 3.3% growth rate posted in the first quarter. Unsurprisingly, digital platforms are growing faster (I estimate that Alphabet, Meta, Amazon, Microsoft, TikTok, Yahoo, Snap, Z Holdings, Apple, X/Twitter and Pinterest combined to grow by 7.4% in 2Q23) while TV network owners within the group are declining meaningfully (Comcast, Disney, Paramount, Warner Bros. Discovery, Fox, RTL, Televisa Univision and MFE collectively lost 7.7% of advertising revenues during the quarter).

Source: Madison and Wall, Company Reports

Weakness in TV – especially in the United States – should be viewed as unsurprising given the degree to which the larger companies who dominate it are shifting resources into pure-play digital platforms. As streaming services are unlikely to be primarily ad-supported, and contain lighter ad loads when they do, accelerating cord-cutting in the US is set to permanently impair growth. In the most recent quarter I estimate that US pay TV subscriptions – including virtual MVPDs – fell by 7.3% year-over-year, the industry’s fastest pace of decline ever. By the end of next year, it’s likely that only around 50% of households in the US will have pay TV subscriptions as we have historically known them.

Source: Madison and Wall, Company Reports

The second quarter’s overall figure for advertising was all the more remarkable considering last year’s very difficult comparables. The second quarter of 2022 saw 12.4% organic growth for this group of companies, as some of the last vestiges of the pandemic-era advertising boom were still being experienced. With significantly easier comparables in the second half of the year I was previously expecting growth rates to improve from here, and guidance provided by many companies reinforces this notion.

Among the digital platforms, the mid-range of Meta’s guidance calls for 19% constant currency revenue growth, while Pinterest is expecting high single digit growth. Snap called for a decline of 0 to 5%, although excluding the company’s growing non-advertising revenues, that probably means more like a decline of 5-10%. Among TV network owners, Comcast expects second quarter trends of mid-single digit declines in ad revenues to continue, while Warner Bros. Discovery has conveyed that they expect high single digit declines in the second half, with the third quarter faring worse than the fourth. On the bright side for this group, RTL expects advertising growth between 0 and 2%.

Looking at ad tech, that sector’s biggest software-focused companies were roughly in line with the first quarter, rising by 15.4%, although the median growth rate for The Trade Desk, LiveRamp, Magnite, Pubmatic, Viant, IAS, DoubleVerify and Innovid actually improved to 8.8% from 6.7% in the first quarter. Even more than the rest of the industry, these companies faced difficult comparables from last year where growth rates were 25.2% on a weighted average basis or 23.2% for the median company.

Interestingly, headcount as reflected in data captured by Linkedin showed a meaningful deceleration between the first and second quarters (and perhaps unsurprisingly, margins improved for the group from 27.5% in 2Q22 to 30.0% in 2Q23). Guidance for the third quarter is slightly less robust – 13.2% on a weighted average basis or 7.5% for the median company here - but presumably this reflects a higher degree of conservatism vs. the conservatism larger companies apply to their guidance.