$360 Billion US Ad Industry To Grow 5.0% In 2023, 4.3% In 2024*

In this note I review a new, original forecast of the US advertising industry covering more than 20 different forms of media, including data through 2028 from 2016 on an annual basis and from 2018 on a quarterly basis. The data is based on my new assessments of approximately 80 individual companies based on their public filings as well as a significant volume of US government data. Please contact me if you are interested in the complete data set.

* Please note headline figures exclude political advertising. Total advertising revenue amounts to $363 billion in 2023, growing 2.0% in 2023 and 8.1% in 2024 including political advertising.

A Return To Normalized Growth For US Advertising

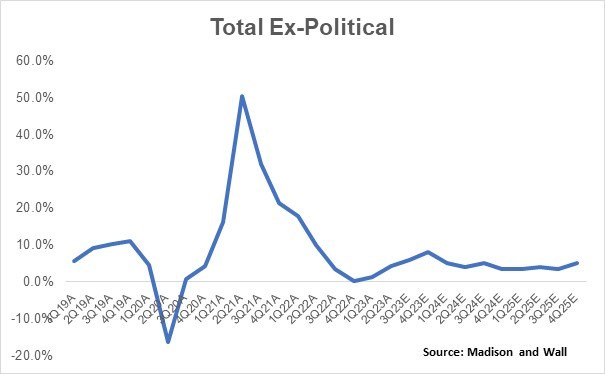

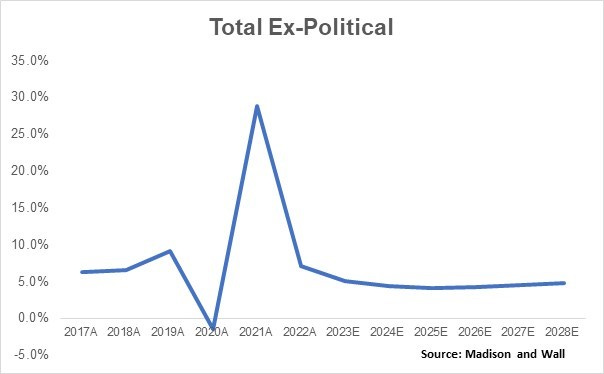

The US advertising industry experienced a period of massive expansion during the pandemic, following on a fairly good end to the 2010s, which also represented a period of above-trend growth both in terms of its own history and the economy as well. Looking forward, it’s highly unlikely that such trends could continue. Instead I expect a reversion back towards the lower end of mid-single digit levels, which should be considered normal, positive conditions for the industry.

Although some overlapping factors supporting the last decade’s expansion are continuing, including increasingly significant cross-border ad budget flows from China into the US, the ease small businesses experience in buying media with self-service digital tools, the heightened competitive intensity between marketers in spaces such as e-commerce and modest amounts of incremental spending from trade budgets in those same e-commerce environments, other factors are unlikely to return any time soon. Specifically, a decade of low capital costs meant that it was relatively easy – and desirable – for businesses to raise vast sums of money and in turn deploy much of it into advertising pursuit of sometimes profitless growth. It’s true that there are always categories that come and go in any given advertising market, but with the scale of investment that we saw in areas such as crypto-currencies, rapid delivery and DTC consumer goods, among others, it’s hard to anticipate new categories which could replace them as growth drivers.

If anything, it could be considered a positive that the industry didn’t fall faster, or even decline over the past year and a half, especially as much of the industry seemed to try to talk itself into a downturn last year by fearing for a recession that never came. I would argue such an outcome was never even likely to occur in the first place given the vast stores of savings for wealthier consumers and significant disruptions to labor markets which empowered workers – including those with lower wages – to secure higher levels of compensation.

Both of those factors should have been meaningful positives for consumer spending, which has always been a much more important singular factor in driving advertising growth than any other economic variable, including GDP. Moreover, high levels of inflation should have boosted the overall ad market, as most marketers I have studied manage their budgets for advertising on a percentage-of-revenue basis. Higher revenue, whether driven by higher prices or higher volumes, should almost always lead to more spending on advertising, unless there is a meaningful decline in underlying economic growth.

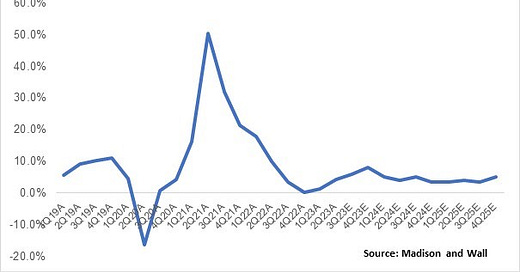

From here, I see post-pandemic conditions normalizing, at least after the advertising market laps unusually soft year-ago quarters. More specifically, after growth of 6% in the third quarter of this year and 8% in the fourth quarter (following on growth of 3.5% and 0.1% for 3Q22 and 4Q22, respectively), I expect growth to normalize in a 4-5% range excluding the effects of political advertising. This presumes underlying economic growth in terms of GDP and personal consumption of around 1-2% in real terms and 4-5% in inflation-adjusted, or nominal terms. Political advertising, growing ever-larger, should account for 3-4% swings in growth each year going forward, and impact virtually every type of media with increasing intensity going forward.

With this context, let’s focus next on individual forms of media. All growth rates cited below exclude political advertising unless otherwise stated. Critically, definitions generally relate to media formats as they exist today. As media owners blur lines across platforms and potentially redefine what their medium is, growth rates may converge across relevant sectors.

Digital Advertising’s Dominance Expands, Led By Retail Media

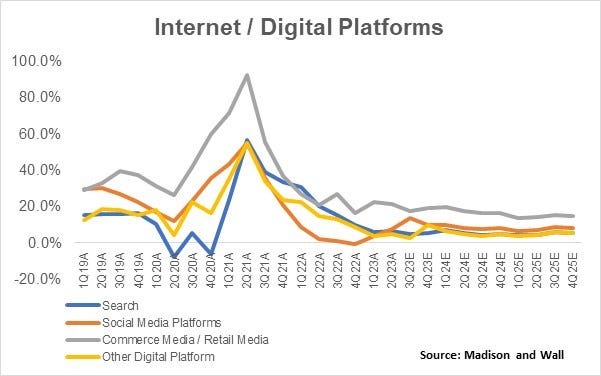

First, what I am calling “Internet / Digital Platforms,” including Search, Social Media, Commerce Media / Retail Media and Other Digital Platforms such as YouTube, Yahoo, Apple and ex-TAC revenue from ad networks account for 64% of all advertising (note that if we quantified the share of advertising that is “digital” across a broader array of media I would estimate that figure at 75% for 2023).

Digital platform-focused companies should collectively grow by approximately 11% this year. That’s similar to 2022 levels, but skewed positively in the second half of 2023 because the comparables from the second half of 2022 are by now so easy (I estimate that these companies grew by only 3.5% in the fourth quarter of 2022). Perhaps unsurprisingly, Commerce Media / Retail Media is a stand-out sector, set to account for approximately $42 billion in advertising revenue during 2023, up 20% from 2022 levels.

To be sure, Amazon is by far the biggest player in this space, but they are far from the only beneficiaries of marketers shifting spending in this direction. Companies such as Walmart, Instacart, Ebay, Uber, Criteo, Booking.com, and Expedia have all built significant businesses which are collectively well-positioned to sustain double digit growth for many years to come. The other platform-focused companies captured here should also continue to expand, although I expect growth to trend towards mid-single digit levels (as should be expected: by 2028 I expect this segment of advertising to account for 75% of the industry. If we include all forms of media, digital advertising formats should account for 85% of the total at that time. It’s mathematically impossible for the dominant component of any given market segment to grow much faster than the broader market in which it is contained).

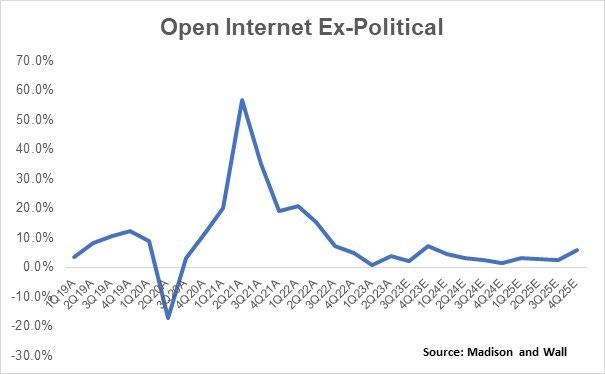

Open Internet Growth Slows, But Opportunity For Ad Tech Follows From Share Gains Within

Interestingly, what we might call “Open Internet” will not grow by much at all going forward as legacy print publications will likely return back to the declines we were seeing prior to the pandemic, although now with a much higher digital revenue skew. Importantly, I note that the ad tech sector – which depends primarily on these non-walled garden environments for their businesses – can grow at a faster rate, at least so long as insertion order-based sales continue to shift towards programmatic trading.

Meanwhile, Television will likely experience ongoing decline from here, both at the national and local levels.

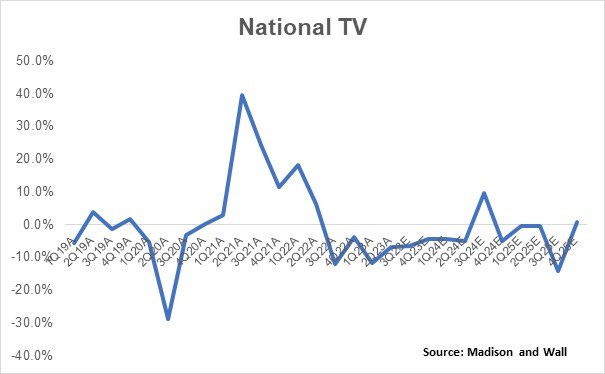

National TV: Significant Challenges Get Worse From Here

The television advertising sector is experiencing what might feel like an existential crisis at the moment. At the start of this year, we had a situation where cord-cutting was accelerating into high-single digit levels of decline, enabled (if not outright encouraged) by traditional TV network owners’ shift of resources and programming budgets into streaming platforms, which have been and are likely to always be ad-free or ad-light at best. And then we had the Hollywood strikes, which increasingly look like they will have a meaningful impact on the production of what’s left of ad-supported entertainment programming, and thus the availability of inventory to meet marketer goals in the latter part of this year as well as the early part of next.

But as of this week these problems are made worse. Last week, Charter Communications, the second largest distributor of video services in the US, conveyed during an investor call that it is now at a point of indifference between fully walking away from its historical business to focus instead on its other telecommunications activities if it can’t persuade Disney (and eventually other media companies) to shift their business models in what are likely unpalatable directions. While it’s possible that most network owners and most carriers will continue to come to terms for carriage agreements as they have for many decades, and that cord-cutting then continues at “only” a high single digit level, it’s also plausible that deals won’t be reached, in which case those consumers who want access to the channel packages they have today will have to subscribe to over-the-top virtual MVPDs such as Fubo, Alphabet’s YouTube TV, DISH’s Sling or – ironically – Disney’s Hulu+ Live who may be more tolerant of the lower profit margins that these platforms are built to manage around.

Not every consumer will make such a shift, instead prioritizing streaming services for their television consumption. The consequences of those changes could be meaningful for advertising, as shifts to streaming makes it almost certain to me that the tonnage of advertising those consumers are exposed to will go down significantly as a result.

The practical challenges of managing reach and frequency – still the key metrics large brands who dominate national TV care about – in this world make this medium far less desirable than it once was, especially as pure-play digital platforms are increasingly capable of satisfying nearly every marketing goal as well or better than any alternative. To be sure, there will be many marketers whose media mix or marketing mix models show them that television’s effectiveness is unparalleled despite its challenges, but as the radio industry has seen, effectiveness does not equal growth, especially as marketers adjust their brands’ objectives to account for different marketing goals enabled by newer media platforms.

I should emphasize that if there is an upside opportunity for today’s owners of television networks, it will occur if they redefine what they have historically sold. To the extent that they can capitalize on what are still-sizeable relationships with marketers to offer a wider array of media products – for example, by creating common identifiers that allow for integrates sales of traditional TV, streaming video and other digital inventory – I think there are opportunities for growth ahead.

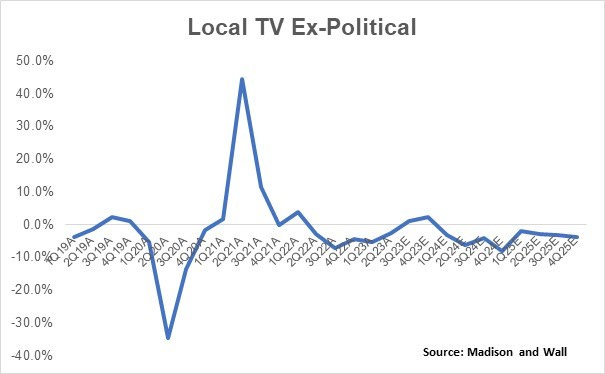

Local TV should collectively experience similar trends, with low single digit underlying declines on a like-for-like basis likely to continue. Local broadcast probably fares better than local cable given the free-to-air nature of local broadcast (although cord-cutting will put retransmission consent-related revenues – now a bigger source of revenue than advertising for local broadcasters – at risk). However, a biannual offset from political advertising that amounts to nearly a quarter of annual ad revenue presently and should amount to a third of annual ad revenue by 2028, will go a long way towards sustaining the business.

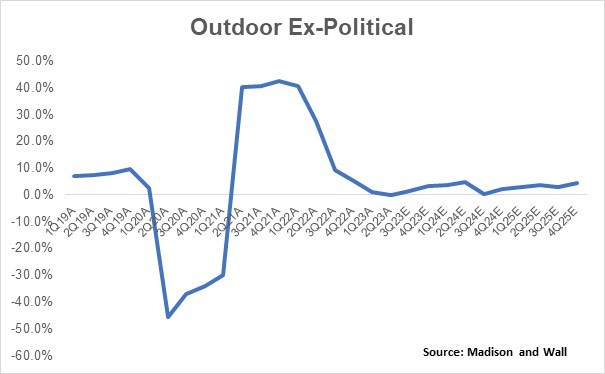

Outdoor Advertising Is Positioned For Modest Growth

Next, outdoor advertising has essentially rebounded back to pre-pandemic levels, and is likely the best positioned of all “traditional” media to experience growth going forward. Arguably led by technology-focused companies such as Apple and luxury marketers, it was already the case that prior to the pandemic outdoor advertising was lauded for its experiential qualities. In a world where television looks significantly less attractive, outdoor advertising probably looks even better by comparison.

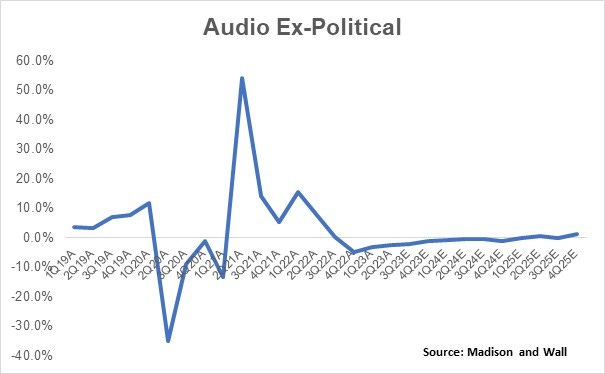

Audio Is Unlikely To Grow Any Year Soon, Although Digital Shifts Are Favorable

I expect that audio advertising will likely be flat in the coming years, supported by high degrees of effectiveness and ongoing investments into digital services, including podcasts, which helps the industry to better capture national advertisers who might otherwise have avoided locally-skewed traditional radio. At the same time, growth will remain limited because the smaller advertisers who historically dominated radio generally continue to have easy access to more scalable alternatives, such as the large digital platforms.

Publishing Will Continue To Face Pressure

Publishing will continue on what was a generally weak trajectory prior to the pandemic. Although digital advertising revenues from publishers will fare relatively better than print, the weight of legacy businesses and disinvestment in the production of content will serve as a drag on the sector, with mid-single digit declines likely to occur in coming years. Note that I believe publishers who continue to invest in their product – whether digital-only or print-digital hybrids – are much more likely to experience growth than those who do not, but profit margins are likely to be far below where they were in a world where content-less classified advertising provided support to the sector. For most publishers, emphasis on subscription or other revenue sources will likely be critical to longer-term growth opportunities.

Direct Mail Declines, Despite Effectiveness.

Direct Mail will similarly experience ongoing declines, although my general view is that this is occurring more out of “fashion” than anything else. I suspect direct mail can still be as effective as it ever was, and probably more effective than many other forms of media. However, as a “print” and “traditional” form of media, many if not most marketers generally steer their attention away from the medium, and I doubt this is likely to reverse itself any time soon. Directories are similarly impacted on the print side, but digital activities are unlikely to drive growth any time soon given the wide range of vastly-greater scaled alternatives that are available to marketers.

Political Advertising Increases In Importance to Industry

Lastly, I want to highlight the evolving nature of political advertising. During 2024, I expect that there will be approximately $17 billion in revenue realized by media owners from political advertising. This is almost triple the $6 billion media owners generated in 2016, although only modestly more than 2020’s $14 billion. Political advertising has become an increasingly important component of almost all forms of media, not only local broadcasting, where it will likely retain an outsized role given its effectiveness in driving election outcomes. However, internet-related advertising has become increasingly important, and as this category continues to grow, its year-over-year skews to growth rates will become increasingly evident.