Agency Holdcos: 2.0% Organic Growth in 3Q23, Led By Media, Offset By Creative. Full Year On Track for 3-4% Expansion

Beginning in January 2024, most Madison and Wall research and related data published on this Substack will primarily be available to consulting or advisory clients, or otherwise as part of a paid corporate subscription. Please reach out to brian@madisonandwall.com if you would like to discuss these services or for more information about the new offering.

With WPP reporting third quarter results today featuring a -0.6% organic decline across the company, the bulk of the global agency holding company group (other than Dentsu) has now reported results.

Source: Madison and Wall, Company Reports

For WPP, Publicis, Omnicom, Interpublic and Havas, organic growth collectively amounted to 2.0%. This was a slight slowdown from 3Q23’s 2.8% despite somewhat easier comparables in the year-ago period (2Q22 was up 9.6% while 3Q22 was up 6.7%). In general where there was weakness (at WPP and IPG in particular) it was blamed on cuts in spending from technology-centered clients.

While these cuts were undoubtedly a factor, company-specific trends are certainly impacted by broader client wins and losses as well as product offerings and other strategic choices, especially as large brand client spending on media and marketing during the quarter likely outpaced agency growth during the period (even accounting for the slowdown in tech client spending.)

By product or business unit, media agencies were generally strong across the group and creative agencies generally weak, as per normal in recent years, although there was some variance among the holding companies on the media side. WPP’s GroupM was up by only 1.6% organically while at Publicis media grew by “high single digits.” At IPG, media agency growth was described as “very strong” with “notably stronger performance” in the third quarter. Media agency growth at Omnicom was also evidently up in the high single digits on a gross basis, at least, as media was described as driving the growth for the combined media and creative agency reporting segment, which rose 6.1% in the quarter.

By region we saw revenues from North America (or the US) for these five holding companies rise by 0.6% - roughly similar to 2Q23’s outcome -- with Havas, Omnicom and Publicis each growing around 3% (although Omnicom’s numbers are in gross terms while Havas’ and Publicis’ are in net terms, so may not actually reflect comparable figures) off set by declines at IPG and WPP of -1.2% and -4.1% respectively.

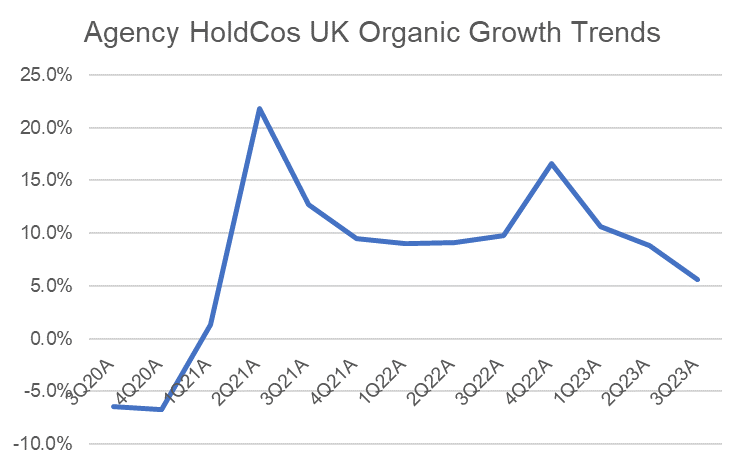

Europe (including the UK) was relatively strong for the group, up 4.1% organically. At the high end, Publicis was up 10.7% and on the low end IPG was down 0.7%. Within this figure, the UK – roughly 40% of the region’s revenue base – for each of the four biggest companies was relatively stronger, up 5.6% organically.

Source: Madison and Wall, Company Reports

APAC was up 0.6% during the third quarter, with declines at IPG of 5.0% representing the weakest result and Publicis’ gains of 3.8% the strongest. China was notably weak where data was disclosed, with declines of 4.2% at WPP and 2.5% at Publicis Latin America was uniformly the healthiest sector for agency services during the quarter with group-wide growth of 13.2% organically with broad-based growth among each of the holding companies.

Looking forward, WPP, like IPG, reduced its guidance for the full year in the wake of the third quarter’s results with guidance at WPP now calling for 0.5%-1.0% organic growth (vs. 1.5%-3.0% previously). At IPG, guidance is effectively for 0%. However, at Omnicom, guidance calls for a range of 3.5%-5.0% (again, on a gross basis) and at Publicis guidance is for a range of 5.5%-6.0%. With Havas probably coming out closer to Omnicom and Publicis and Dentsu closer to WPP and IPG, collectively, the large agency group now looks poised for around 3-4% growth for the full year.