Chocolate Industry 2025 Update

Our primary focus at Madison and Wall relates to all things advertising, and we love studying individual marketer categories, especially when those industries are significant advertising segments and even more-so when they produce delicious products. The chocolate industry is one such category, and not coincidentally, ties into our annual Chocolate Marathon in Paris (this year on June 22 – contact us at brian@madisonandwall.com for details if you would like to join us).

For context, manufacturer Barry Callebaut estimates (using its data and that from Euromonitor and Innova) that global retail chocolate sales amounted to $130 billion last year. If after deducting for retailers’ gross margins, manufacturers received $100 billion of that figure and allocated 5% of their revenue to advertising (Hershey’s company-wide advertising expense to revenue ratio amounted to 5.4% last year and at Mondelez the figure was 5.8% for reference), we can estimate that the category would have been responsible for around $5 billion in annual spending for media owners, or about half a percentage point of the world’s total.

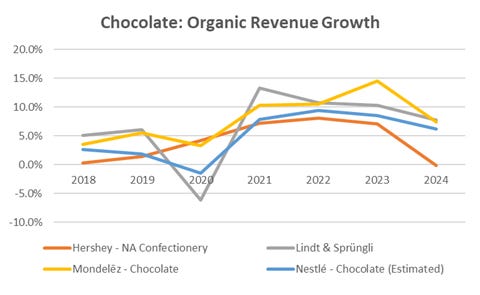

Looking at a composite of significant publicly listed companies or segments from within the industry, we can see that organic growth decelerated fairly meaningfully in 2024. Collectively at Hershey, Lindt & Sprüngli, the chocolate segment at Mondelez, and the confectionary segment at Nestlé – a group that represented $33 billion in revenue last year – we can quantify 5.1% organic growth, down from roughly 10.3% in FY23 and similar inflation-driven levels in 2022 and 2021.

Source: Madison and Wall analysis of company reports

Among the group, Nestle, Mondelez and Lindt fared similarly last year with growth ranging from 6-8% and trends for the first quarter of 2015 showed acceleration in revenue for Nestle and Mondelez (Lindt only reports on a semi-annual basis). Earlier this month, executives at Nestle stated to investors that all expected price increases had been passed onto consumers, driving much of the growth within the segment. Similarly, at Mondelez the company attributed their acceleration to their strong pricing strategy, which had been in the works for more than a year. By contrast, at Lindt, company leadership stated to investors that they experienced muted growth because of a single-digit decline for their Russell Stover brand, due to “pricing issues” and efforts to streamline the portfolio. Hershey struggled more than others during 2024 with only stable organic revenues for its North America confectionery segment last year. During the first quarter these sales fell by -15% year-over-year, driven by double-digit “volume headwinds” that were slightly offset by elevated pricing, according to the company’s most recent earnings call. Importantly, last year’s first quarter benefitted from a high single digit revenue boost due to accelerated shipments which produced a 10% revenue gain during 1Q24. The timing of Easter in 2025 (occurring in 2Q25) vs. 2024 (occurring in 1Q24) was also a factor in their recent results.

Most notably, for those not following the chocolate category as closely as us, the cost of commodity cocoa (chocolate’s underlying ingredient) remains elevated at around USD$10,000 per metric ton, equivalent to $1.00 per 100 grams or around $0.50 for a typical 2 oz mass market chocolate bar. Costs were typically well under $3,000 prior to a spike that began two years ago and has held since, attributable to a mix of changes in climate, plant disease and government policies.

Still, the higher pricing for the underlying ingredient in chocolate that has persisted long enough that no finished product manufacturers would not be able to refrain from passing along costs leads to interesting dynamics that other consumer goods sectors – such as those suddenly exposed to high tariffs around the world perhaps? – might experience going forward.

As B2B-focused chocolate manufacturer Barry Callebaut has characterized it, consumer-facing chocolate businesses need to consider pricing, changes in price-pack-architectures, “cost-effective recipe adjustments” as well as “compound reformulations.” As another tactic, Mondelez has maintained “entry level pricing” to drive consumption. Spending on advertising is not disclosed by every company in this space, and what does get disclosed does not refer to chocolate alone, but interestingly total spending on advertising (or marketing) during 2024 was relatively flat at Hershey, Mondelez and Lindt despite the cost pressures each of these companies faced. Alternately, given the consequences of rising prices, generic or store-brand chocolate may be proving to be more appealing to consumers, forcing branded marketers to sustain spending on advertising at levels that is higher than they might otherwise prefer. Lindt stated some of the advantages of advertising in its most recent annual report where it wrote “As brand awareness rises, our brand equity strengthens, encouraging consumers to pay a premium for our high-quality products.” Going forward, as of March at least, Lindt stated it will increase and/or improve ad spending and investments behind its brand to drive further growth in the second half of this year.