In Europe, Google, Meta and Digital Platforms Gain Share of Wallet Vs. TV Advertising, As in US

Beginning in January 2024, most Madison and Wall research and related data published on this Substack will primarily be available to consulting or advisory clients, or otherwise as part of a paid corporate subscription. Please reach out to brian@madisonandwall.com if you would like to discuss these services or for more information about the new offering.

One of the interesting trends I have observed over the past year is how CEOs and CFOs of TV networks around the world tend to characterize the current environment as “challenging,” usually implying that macro-economic conditions are behind the weak results for advertising that we’ve seen in recent quarters. Few have acknowledged that loss of “share of wallet” is generally the biggest trend impacting the business.

Perhaps they do so privately, but if so, it doesn’t appear as it many of them are taking significant actions to address this issue. There are certainly some hopes and minor investments to diversify or otherwise pursue growth from digital forms of ad-supported TV. However, it doesn’t seem likely that meaningful amounts of incremental revenue will follow from any of the initiatives I’ve seen so far.

It shouldn’t be surprising to point out that digital platforms are gaining a significant share of advertising spending everywhere around the world, both from newer advertisers whose media mixes were always digitally skewed and from older marketers who historically made shifts on a more gradual basis. For this group of marketers, cuts to print spending were a primary source of funding for digital media through the 2010s. However, at the present time there’s only one significant pool of spending left to draw from, and that’s television.

These factors are much more important drivers of spending than some of the more commonly cited challenges such as cord-cutting or problems with measurement. For a point of comparison, we can see the similar trends in Europe where cord-cutting is much less of an issue (pay TV penetration is generally low in most markets, with free-to-air channels dominant) and where most countries have measurement systems led by the industry through a joint industry committee.

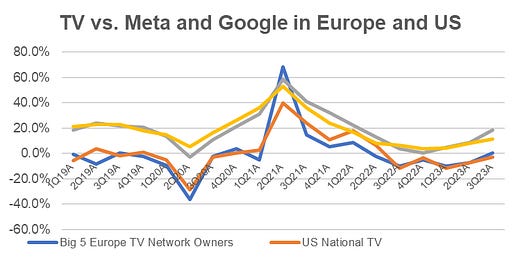

To illustrate, I’ve built a composite of ad revenues at the five biggest European TV network groups – RTL, ITV, Pro7Sat1, MediaForEurope and TF1, which collectively account for around 40% of European TV advertising – and compared their results to estimated regional growth in advertising revenues at Google and Meta in local currencies.

Similar to the United States, where national TV probably fell by a low to mid-single digit percentage during 3Q23 while Google and Meta grew by a much faster pace (around 12%), in Europe I estimate that the big 5 European TV network groups’ ad revenues were roughly flat (supported in part by a 10% decline in the year-ago quarter) while Google and Meta’s European ad revenues were up by much more (around 18%) in comparable currency terms over the same period of time. Between 2019 and 2023, the five aforementioned European TV groups will likely experience around a 3% decline while Google and Meta will approximately double their ad revenues in the region, much as we are seeing in the US. Although we’ll see new estimates for the region from GroupM, Magna and Zenith in the weeks ahead, television advertising will probably total around 30 billion euros in Europe this year. By contrast, Google and Meta together will have around 90 billion euros in revenue in the region this year.

Importantly, it’s not just Google and Meta outperforming TV: Amazon, TikTok and Microsoft (likely the world’s number three, four and five sellers outside of China this year) all posted better growth globally than a European or US TV advertising composite, and they probably outperformed in individual regions, too. These three companies probably account for another 15-20 billion euros within Europe, or half of television advertising.

A side note to consider given these data points: commentary that TV networks provide on macro-economic trends are impacting their businesses are mostly guess-work given how their shares of wallet are falling. It’s nearly impossible for a TV network group to know with any precision how well any of Google or Meta – let alone Amazon, Tik Tok or Microsoft – are faring in any one country outside of the handful for which we can calculate relatively specific estimates using public information.

As in the US, I think the “easiest” opportunities for TV network owners to improve their businesses will relate to driving costs out or by looking for new revenue streams from consumers. In Europe, there are likely many opportunities for network owners to drive out costs by operating on a pan-regional scale to realize operating cost efficiencies while plowing those savings into programming that works everywhere (while still investing heavily in local language content, much as Netflix and Amazon are doing). From there, today’s network owners would be better positioned to compete with the American streaming services. Although consumers may not be used to spending anywhere near as much on video services as they do in the US, my guess is that the relative value of video can be a compelling proposition and presents a source of long-term growth (consider Netflix growing from just over 4 billion euros in revenues in EMEA during 2018 to a figure that will significantly exceed 10 billion euros this year).

As for advertising, the only approaches I can think of to drive growth will require much harder work. As I’ve argued could be true for the US, I think there should be opportunities for TV network owners to work towards establishing a more unified video advertising industry, including Tik Tok and YouTube on and off the TV screen. If the premise that video is video in the eyes of the consumer (and therefore marketers should plan around that) were to become commonly held, and if buying operations and measurement were organized around this idea, TV networks would have a better chance of competing for a larger and still-growing pool of spending that they don’t currently tap into today.

While we do see some examples of media companies offering inventory across owned & operated media properties using a common ID (as in Germany where RTL is doing as much with its assets there) a much more scalable solution may follow if a TV network owner were tightly integrated with one of the mid-sized digital platforms, focused on selling “outcomes” with indifference for where the ads actually run and then scaling the approach across the region. Of course, making this idea work in practice would not be without significant challenges. However, the pursuit of such an approach would help move any one TV network from fighting for its share of a declining pool of spending towards fighting for a growing share of a greater number of marketers’ wallets, which is ultimately the only way for today’s TV networks to experience longer-term growth.