NEW US AD FORECAST: Strong Advertising Trends In 3Q23 Indicate Better-Than Expected Full Year 2023 and 2024

New Quarterly Forecast Through 4Q28 With Historical Figures Updated Through 3Q23

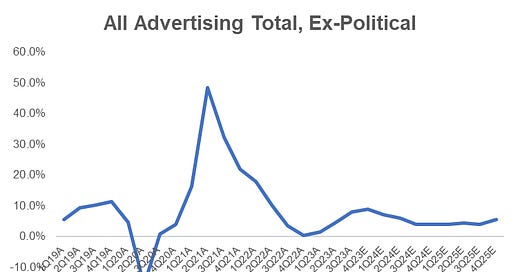

5.9% Underlying* 2023 Ad Revenue Growth Expected Now Vs. 5.0% Previously. 2024 Expectations Also Raised, Now to 5.2%

*Excluding political advertising

Beginning in January 2024, most Madison and Wall research and related data published on this Substack will primarily be available to consulting or advisory clients, or otherwise as part of a paid corporate subscription. Please reach out to brian@madisonandwall.com if you would like to discuss these services or for more information about the new offering.

During 3Q23, I estimate US advertising (including directories and direct mail but excluding political advertising) grew by 8.1%, a meaningful acceleration over 2Q23’s 4.6% rate and 1Q23’s 1.6%. This acceleration in the most recent quarter was expected, if not to the same degree of strength as we ended up seeing. It was aided by relatively easy year-ago figures when compared with the growth rates observed in the first half of the year: on a comparable basis 1Q22 grew 17.8% and 2Q22 grew 10.2% – aided by some left-over spending from companies who benefitted from no or low-costs of capital, such as those in the crypto or rapid delivery categories – while 3Q22 only grew by 3.6%.

Source: Madison and Wall

Digital Advertising Accelerated To Best Level Of Growth Since 1Q22

By medium, I estimate that for the third quarter of 2023, digital platforms grew by 14.6% excluding political advertising, or 12.2% including it (primarily in the year-ago period). Search was up 8.7%, social media platforms were up 13.8%, commerce media platforms grew 22.8% and other digital platforms were up around 5.4%.

TV Continues To Decline, With Connected TV Taking Share

Meanwhile, during 3Q23 national TV was down by approximately -3.2%. If we exclude sellers of TV advertising who do not operate traditional broadcast networks (i.e. Amazon, Roku, Vizio, etc.) I estimate that traditional sellers of TV advertising saw declines of -5.6% including their connected TV or digital inventory.

Within national TV, digital/connected TV including TV networks’ streaming services grew by 11.6% to account for 34% of total revenue (up from 30% of all national TV in the year-ago quarter). As I’ve written previously, connected TV and digital forms of the medium are not sources of meaningful incremental growth. Instead, it takes share of spending as a growing share of gross ratings points are produced in that environment. As before, the overall medium faces long-term growth challenges primarily because the large advertisers who dominate TV need to shift spending away from TV to fund additional digital spending and this shift is not offset by growth in spending from newer advertisers.

Local TV, including broadcasting and cable, was not immune from these trends, although the decline was less pronounced vs. national TV with a -2.8% fall year-over-year. However, growth in political advertising was not particularly strong as it only grew by 2.5% vs. the same period four years earlier. Year-to-date, spending is up much more substantially on a four-year basis, but down significantly vs. 2022 levels. Of course, spending at this stage of the 2024 election is not necessarily meaningful as around 80% of total spending occurs in even years (with more than half of that amount in the fourth quarter of the even year alone).

Source: Madison and Wall

Other Media Is Mixed, With Outdoor The Only Traditional Form Likely To Continue Growth

Looking at other media, outdoor (including cinema and digital OOH) advertising was up 3.0% ex-political while audio (including digital audio) was down -2.6%, similar to the decline for publishing of newspapers, magazines and related digital inventory. Among other forms of print, the small and increasingly unimportant directories business was down by -19% while the much larger and often-ignored direct mail advertising business operated by the USPS was once again down by 5.4% on an ex-political basis.

Source: Madison and Wall

3Q23 Was Strong Vs. Expectations. Suggesting Stronger-Than-Expected 4Q23, Too

Relative to my prior expectations, the third quarter was a very good one: in September I anticipated only 6.0% growth excluding political advertising, including 12.3% growth for digital platforms and a -6.5% decline for national TV including its digital extensions. Publishing also appears to have fared better than I expected by several percentage points based on my process for establishing estimates (which, it should be noted, is relatively subjective when compared with other media given the limited numbers of companies within the sector who make public disclosures). Among other media, outdoor, audio, directories and direct mail saw results which were very close to what I originally expected.

Looking forward, there appears to be a significant degree of positive momentum in the US advertising industry despite sentiment that often appears to be negative. Although there was certainly some concern among investors about curtailed spending by marketers during the first few weeks of the Israel-Hamas war – possibly heightened by commentary from some early-reporting public companies who had soft results – indicating that some advertisers may have paused activity for a brief period of time, I don’t believe the broader industry experienced noticeable deterioration from the underlying trends that were otherwise proceeding as the third quarter turned into the fourth.

If anything, because last year’s comparables were so easy (4Q22 was barely up, rising only 0.2% as the post-pandemic spending boom faded, albeit at a level that was 27% higher than three years earlier) we should see an acceleration in underlying advertising growth in the coming quarter. With that in mind, if growth expectations need to be elevated vs. 3Q23, the forecast for 4Q23 needs to be higher, and so I am increasing my expectations by one percentage point increase vs. expectations I had previously (from 8.0% in my September forecast to 9.0% now on an ex-political basis). This would result in a 5.9% underlying growth rate for the US ad market for all of 2023.

Secular Factors Likely Drive Growth

Underpinning these expectations, there are many factors likely contributing to the positive outcomes we are observing for advertising, including significant cross-border spending (primarily from manufacturers based in China) and a growing reliance on e-commerce in general, which produces companies who are much more advertising-intense than traditional retailers and manufacturers. It’s also plausible that the growth in new AI-based advertising products (such as Performance Max and Advantage+ from Google and Meta, respectively) could be drawing some incremental spending into the market as well. Importantly, these factors are somewhat independent of economic growth in the US, which can help explain why we could see economic growth go in one direction and advertising growth go in another if the US were to enter a recession (which, at any rate, I continue to believe is unlikely to occur).

Because it’s hard to anticipate the end of a driver of momentum when it’s hard to identify exactly how much that specific driver is contributing to growth or when that driver will normalize, it seems reasonable to assume that next year will also see elevated growth, and so I am also raising my 2024 forecast nearly a percentage point higher, for a 5.2% underlying growth expectation vs. 4.3% previously. Subsequent growth rates are only raised marginally from current expectations to a range that generally remains between 4% and 5%.

At a medium level, over the next five years I continue to expect digital advertising to decelerate towards a high single digit level (by 2028 the digital pure-play platforms not including digital extensions of traditional media, and not including “TV” properties they operate) should account for around 75% of the industry’s total, which necessarily means growth rates have to converge towards an industry average. National TV should continue to decline at a low single digit level, although a growing share will undoubtedly be accounted for by the likes of Amazon and any other platform that can persuade advertisers their digital platforms are “TV” which should be managed alongside the medium’s traditional inventory. Outdoor advertising probably fares better than all other traditional media while audio in all of its forms will probably be flattish. Trends for directories and direct mail likely continue much as they have in recent years.