New US, Canada Ad Forecasts, New Programmatic Ad Forecasts, Engines of Ad Growth, Large and Small Advertiser Trends + Pinterest To Acquire tvScientific

Madison & Wall: Saturday Summary for December 13, 2025

Join us on Friday December 19 at 1pm eastern time for a webinar to hear a discussion of our latest ad forecasts, hosted by Measured. Register in advance here.

On this week’s M&W Podcast Luke Stillman and Brian Wieser review our work of the week. Separately, on Agency Business from Madison & Wall and Fusion Front Media, Olivia Morley and Brian interview Mercer Island Group’s Steve and Robin Boehler.

Weekly Work:

Madison & Wall U.S. Ad Forecast: December 2025 Update

Madison & Wall Canada Ad Forecast: December 2025 Update

Inside the $36 Billion Programmatic Market: Growth Drivers and Structural Constraints

The Hidden Engines of Ad Growth: Five Reasons Ad Spend is Outpacing Consumer Spending

Large and Small Advertisers: Different Paths, Same Playbook

Pinterest Acquires tvScientific: As Growth Slows, A Bet on Performance, SMBs, and Programmatic CTV

Sponsored by Measured

Connecting Media Spend to Real Business Results

Marketing measurement is evolving fast. Causal Media Mix Modeling is emerging as the new standard for understanding which channels truly drive growth. It combines modeling, testing, and real-world data to give teams a more accurate, actionable view of marketing performance.

Read The CMO’s Guide to Causal Media Mix Modeling

More Context:

This week Madison & Wall released its latest detailed quarterly ad forecasts for the United States and Canada across the whole industry.

In general we are raising our U.S. advertising forecasts following another exceptionally strong quarter during 3Q25 and also adding to our expectations for growth in 2026. A headline 6.6% ex-political growth rate represents a step down from 2025’s pace of expansion. The industry’s expansion is expected to moderate throughout the year as policy, geopolitical, and regulatory pressures begin to accumulate. Unsurprisingly, commerce media, social media and search lead the way by media channel.

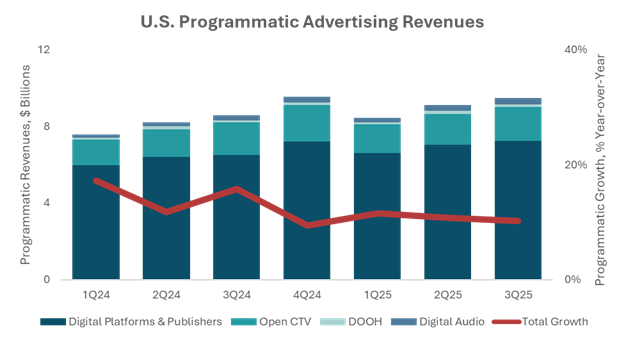

Within digital media, we expect that programmatic buying will represent 74% of total open-internet revenues in 2026, including nearly 90% of revenues from the largest segment of the market - digital platforms and publishers.

Source: Madison & Wall

Operationally, AI is already reshaping budget allocation through the rapid adoption of black-box buying platforms such as Advantage+ and Performance Max. These systems bundle creative, optimization, and measurement into automated engines that prioritize convenience and outcomes over transparency and control. We expect these AI-powered environments to capture a significant share of incremental industry revenues in 2026, further revealing marketer preferences for convenience and price above all else.