Pay TV's $100 Billion Funding Source for an Ad-Free Streaming Future

A common refrain I hear or read about with respect to the growth prospects for ad-free streaming services is that consumers only have limited budgets, and thus, if they adopt these services they will necessarily prioritize ad-supported streaming instead.

My counter-point has been that a) in streaming environments where most content is consumed on-demand, most consumers probably won’t tolerate much if any advertising in most instances and, at any rate, the affordability question ignores the significant pools of spending that streamers can tap into. The former question is one I’ll leave for others to quantify, but on the latter I’ve (re)built some data sets to refine my assertions.

In the United States, at least, I believe that we should generally look at spending on video entertainment as one pool of spending (to be sure, “leisure” may be a better category of spending to analyze for many people, but that analysis can also wait for another day).

If we add up spending on pay TV to cable and satellite operators as well as their virtual MVPD competitors (based on my analysis of video-based revenues for all of these services), box office spending (from BoxOfficeMojo), home entertainment purchases and downloads and spending on streaming (from trade group Digital Entertainment Group, or DEG), I estimate that total spending amounted to $144 billion in the United States last year, up 4.5% over 2021. Of that money, I estimate $103 billion went to pay TV while data tracked by DEG (but originated from Omdia) indicates subscription streaming amounted to $30 billion.

Source: Madison and Wall, Company Reports, DEG, BoxOfficeMojo

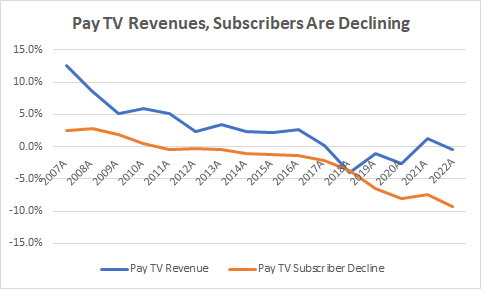

Streaming has, unsurprisingly, grown rapidly, nearly doubling over the past five years at the same time as pay TV lost 7% of its revenue – it peaked in 2017 at $110 billion – and then accounted for more than all of the growth in spending by consumers on video. It may be hard to recall, but consumers used to spend a significant amount of money on rentals, downloads and cinema: around $27 billion in 2010, before streaming subscriptions were a thing. Most of that money has gone away, although there’s still some more room to run with $4 billion on rentals, purchases and downloads as well as $7 billion at cinema box office last year.

At minimum I expect continuing declines in pay TV spending to support more growth in streaming. I calculate that spending on pay TV declined by around 3-4% year-over-year during the last quarters of 2022 and the first quarter of 2023, with subscriptions falling by around 7% to 77 million, including vMVPDs. If total spending on video were to grow as it has over the past decade (a CAGR of just under 1%) while pay TV spending continued to fall by 3-4% all year, that would free up around $5 billion in spending to add to 2022’s total, and allow streaming to grow by around 17% - identical to rates observed in 2022 and only slightly below what we saw in 2021. Of course, this spending is now divided up among a greater number of services than in past years, but the impact on overall TV viewing probably won’t be much different.

Source: Madison and Wall, Company Reports

None of this says that consumers won’t take ad-supported offerings in some instances, but the argument that they will inevitably do so continues to seem unlikely to me, especially given the budget flexibility consumers will demonstrate as they shift spending away from traditional sources of video-based entertainment.

The consequences of doing so remains significant for advertisers, as growing viewing of ad-free streaming will continue to negatively impact the capacity of ad-supported TV to meet marketing and media goals related to reach and frequency.