US Services Spending Up 9.7% During 1Q23, Reflecting Ongoing Growth For Important Advertising Categories

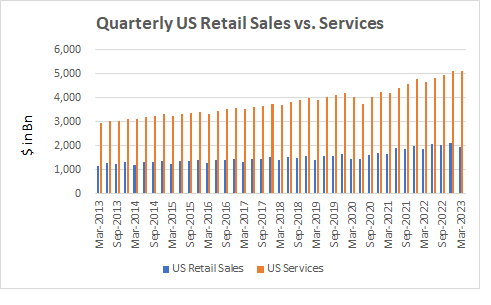

Source: Madison and Wall analysis of US Census data

One of my favorite under-appreciated data sets provided by the US Census Bureau is the Quarterly Services Survey data. It receives substantially less attention than Census’ monthly retail data, presumably because it is available less frequently and has a slightly longer lag.

However, services are substantially more important to the overall economy than retail is. In the US, 2022 saw services businesses generating $19.6 trillion of receipts from their customers last year vs. only $8.1 trillion for retailers. Over the past decade, services have grown faster as well: through the most recent quarter, over the last ten years services grew by a CAGR of 5.7% vs. retail which grew 5.2% (although I note over the past five years with the pandemic-era boom of spending on “things,” retail growth averaged 6.9% while services growth averaged 6.6%).

More importantly, on data I’ve analyzed from the IRS, retailers accounted for only 17% of all spending on advertising in the US during 2019 (with 1.4% of turnover allocated to advertising) vs. spending on services which accounted for 46% of advertising (and 1.7% of turnover deployed to advertising spending) with information services (including telecom services and video services) and financial services each accounting for nearly a third of services-related ad spend. Some services categories spend substantially more than the services average, with educational services at 4.7% of revenue and the aforementioned information services sub-sector at 3.7%.

I reviewed this data as the newest Services data came out on Friday covering the first quarter of 2023. Once again it showed robust growth, rising 9.7% during the most recent quarter. By contrast, retail only grew by 5.2% during the same period. Accommodations and Arts, Entertainment & Recreation were up nearly 20% year-over-year. Finance and Insurance was up 14.9% (although this wasn’t all positive for the economy necessarily: within the category, Credit Intermediation and Related Activities grew 37.5% year-over-year).

While there are many reasons why growth should decelerate as the year progresses, once again I continue to point to recent data as illustrations of economic conditions which are generally more positive than most participants in the advertising industry tend to appreciate.