WPP and Global Agency HoldCo 4Q24 Trends, TV Trends + More CPG and Walmart Trends

Madison and Wall: Saturday Summary for March 1, 2025

Each week on the M&W Podcast, we discuss Madison & Wall’s latest research. Last week we introduced our Advertising 101 series, a multi-part (i.e. every week all year long) tutorial that will explain how the industry really works and why money flows as it does.

The series continues with a focus on agencies, which followed our prior focus on marketers and the ways in which they allocate resources (episodes 17-22). This week we look at the role of the global account lead, this week with Carl Hartman (formerly of WPP and Interpublic). This follows last week’s interview with Macquarie Securities’ Tim Nollen, who we talked with for a broader perspective on the agency industry. It’s all available on Spotify, Apple, or wherever you get your podcasts.

You can also hear more about our work on agencies through the Agency Business podcast, a collaboration with FusionFront Media’s Olivia Morley’s. This past week’s podcast included a longer-form interview with the aforementioned Tim Nollen.

Weekly work

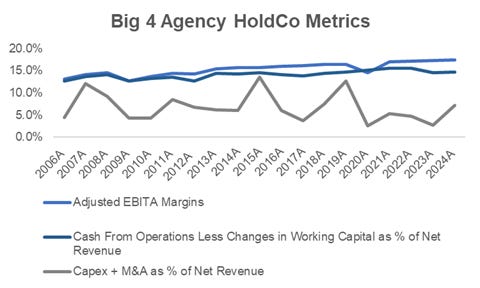

This week we published an extensive analysis of the global agency holding companies, updating our 18 years (i.e. the modern era) of a wide range of industry data for WPP, Publicis, Omnicom and Interpublic normalized for key accounting differences. Perhaps surprisingly, 2024 was a record year for revenue and operating income margins for the group, and also represented a strong year for cashflows, too

We reviewed WPP’s results, too, which made fairly clear that many challenges remain at the company’s creative networks; negative growth guidance for 2025 indicates those challenges are likely to continue in the year ahead

Many, many other media owners produced results during the week, and while we’ll review more of those results over the next week, perhaps the most important set of data points showed negative trends for Paramount and Warner Bros. Discovery but unsurprisingly solid growth for political advertising

We published an extensive analysis of key takeaways from the CAGNY (Consumer Analyst Group of New York) conference along with our take on important operational details that followed from Walmart’s most recent results. It looks like a slowdown in demand from consumers is beginning to drag on the packaged goods sector.

More Context

As part of our analysis of the agency sector, we published industry level data we have aggregated through our analysis of individual companies. The following chart provides a visualization of profit margins, cash flow margins and capex + M&A as a percentage of revenue, as illustrations of the data we track. This data and much more is available to corporate subscribers and advisory clients upon request.

Source: Madison and Wall analysis of company reports