Disney/ABC Divestiture Considerations

News that Disney and Nexstar have engaged in conversations regarding the sale of not only Disney’s O&O TV stations, but also its storied broadcast network ABC is significant, because although the idea of a network owner selling its local stations has seemed like a good idea for a long time (although I’m sure others thought about it earlier, Rob Norman and I wrote about such a scenario involving Paramount back in 2019 in a piece for GroupM entitled “If Content is King, Who Wears the Crown?”) the actual action of selling a big broadcast network is, in a word, dramatic. And Nexstar isn’t the only entity potentially interested, as evidently Byron Allen’s Media LLC is also putting forward a bid for ABC, FX and NatGeo, potentially worth $10 billion, according to Bloomberg.

Several observations or questions related to these potential transactions immediately followed to me:

With approximately $3 billion in annual advertising revenue, Nexstar buying ABC would add to its existing $2 billion+ of annual ad revenue to become almost as big as Fox. In fact, as a seller of advertising it would become larger than Snap, placing Nexstar as the 12th largest seller of advertising globally, and probably a top 10 seller in the US. Disney would still remain within the top 10 given the size of Hulu and (for now) its cable businesses including ESPN.

As a provider of news-related programming a Nexstar-owned ABC News would immediately scale up its presence and influence given the recent investments it has made in NewsNation and in local broadcast news. At the same time it would also likely start to face more scrutiny than it has before, in particular around its relationship with the Saudi Arabia’s sovereign wealth fund-backed LIV Golf. As Disney saw for itself last year, influential media companies often have to either pick political sides or have those sides picked for them, and face consequences one way or the other.

Under either of the transaction scenarios, how would ABC’s digital content distribution evolve, and what would that mean for Hulu? If Hulu relies heavily on ABC for a significant portion of its new programming, would that content remain on Hulu? Or would Nexstar establish its own digital strategy, developing its own app or licensing content to others once it were able to do so? How big (and profitable) would Hulu be in this case (of course, if Hulu were to be smaller or less profitable that might actually be helpful for Disney in context of its pending valuation exercise with Comcast).

Relatedly, if Disney, did not continue to possess comparable (or greater volumes of) rights to general entertainment for its streaming platform, the value of Disney+ and Hulu would surely diminish in the eyes of consumers, and ultimately of investors, too. It’s possible to invest in content independently of what was on the ABC network of course, but then that begs the question of why bother selling the network with the stations.

How well would ABC’s advertising business fare without cable networks (as contemplated in the Nexstar scenario) or streaming (as contemplated in both the Nexstar and the Allen Media scenarios)? For the period around which the next upfront negotiations will be centered – for the 2024-25 broadcast season – pay TV penetration will be well below 50%. The reach potential of an ABC without a scaled streaming asset will move the network well behind the front-of-the pack group where Disney’s networks presently sit, giving them an advantageous early look at advertiser budgets. Presumably this would negatively impact ABC’s national / network revenues.

On the other hand, given the interest that marketers have exhibited in supporting Black-owned media, a Byron Allen-controlled ABC would practically be the only scaled media Black-owned media business in the United States. As a result, it would probably be able to see outsized growth in advertising relative to the rest of the television sector at least.

How would sports rights be divided up with ESPN? And how appealing would ESPN be as a bidder for sports content without a broadcast partner? Certainly Turner Networks was able to become a player in this space without broadcast assets, but presumably on worse terms given any league’s interests in ensuring broad distribution of at least some of its games when possible

Is it possible that Nexstar or Allen Media – or someone else – might be interested in the stations without the network? For Nexstar or Allen, such a transaction could still be very positive. And I would also argue this would place Disney in a stronger position because of the benefits of a broad reaching content producing machine, even if it might have a weaker relationship with its affiliates. For a buyer of broadcast assets, pay TV distribution is likely going to erode at an accelerating pace, and this will inevitably pose a drag on retransmission consent fee-based revenues which have driven the business – these distribution revenues are often more important than advertising as a revenue source. But there’s still a lot of cash to be harvested, and even an opportunity to invest in locally relevant content. And if things really go south, it seems highly likely that government support would be available in one form or another as the “free” radio broadcasting spectrum station owners were historically issued would probably be bought back at some point in time.

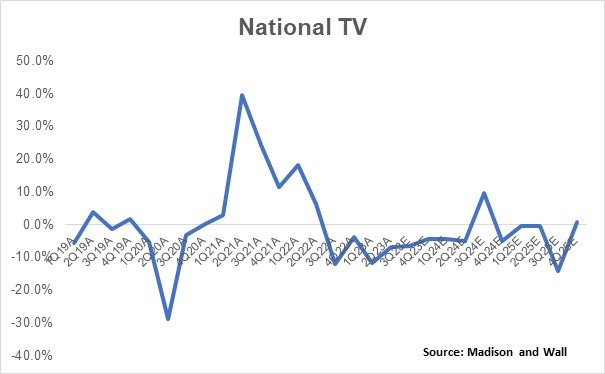

Regardless of how this plays out, television is unlikely to be a growth business in relation to its advertising revenues, as I laid out last week in a review of the US media industry and my advertising forecast through 2028. More specifically, I continue to expect a low single digit decline for the medium, even including connected TV-related advertising.

Consequently, unless there are plans to meaningfully alter programming in a manner that drives significant share gains within the medium, or plans to build a bigger cross-platform asset, expectations from any potential buyers will need to be tempered for value to be ultimately realized.