Out-of-Home Advertising: Top 4 Grew 4.7% Organically in 1Q23, Ongoing Growth to Come

Out-of-home advertising is a relatively small, but nonetheless important part of the global advertising industry, accounting for approximately 4% of the industry’s total, per data from GroupM.

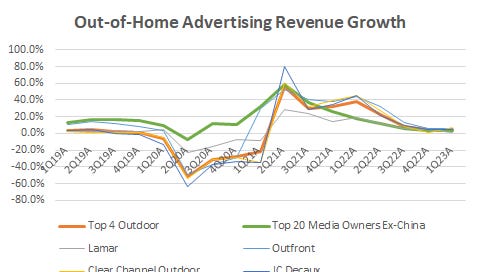

Following on last week’s analysis of the world’s top 20 media owners’ quarterly ad revenues, and prior to Tuesday’s news regarding an activist’s interest in Clear Channel Outdoor (where an investor, Legion Partners, announced their ownership of 5.1% of the equity, and advocated for an accelerated “pursuit of strategic alternatives” at CCO) I was curious about the performance of outdoor advertising sector on a relative basis during recent quarters. By focusing on the four biggest companies in this space – Clear Channel, Lamar, Outfront and JC Decaux – we can see data for a group that represents nearly 40% of the world outside of China and get a good sense of the sector’s trajectory.

As I noted last week, the top 20 media owners grew by 3.2% during the first quarter of 2023, probably only slightly faster than the total advertising industry outside of China. This modest pace of expansion was likely heavily impacted by the very difficult comparables of 1Q22 (when the top 20 grew by approximately 17.8%) rather than macro-economic conditions, which were generally positive on a year-over-year basis in most parts of the world. Out-of-home advertising fared slightly better, with the group of four rising by around 4.7% on a like-for-like basis(1), following on a 38.3% growth rate during the first quarter of 2022.

Source: Madison and Wall, Company Reports

However, 1Q22 was no easy comparable for those operating in the out-of-home space. Unlike other large media companies, who mostly had a fairly strong pandemic, outdoor advertising was devastated during the same period. Like-for-like revenues for this group of companies fell by more than half (around -52%) during the second quarter of 2020, and continued to experience significant year-over-year declines for the next three quarters.

Consequently, as absolute levels of revenue are likely to come in above 2019’s outcome for each subsequent quarter this year, I would now characterize current levels of spending as relatively normalized, providing a new base against which modest growth should continue beyond 2023.

But what does normal growth look like for out-of-home advertising? My view has been for many years that this sector is well-positioned to grow faster than most of the rest of the advertising industry. For many years ahead of the pandemic we saw solid low or mid-single digit growth for outdoor, as the sector expanded at a pace that was faster than what we saw from any other “traditional” medium, including television, which basically didn’t grow between 2014 and 2019. The reasons include:

Concerns around the durability of TV, including the general erosion of viewing of ad-supported content were growing, while outdoor made progress in improving how it was measured

The increasing availability of digital billboards from traditional vendors helped bring costs down for some campaigns and made it possible for new advertisers to use the medium with less of a lead time

Specialized digital out-of-home (DOOH) vendors helped expand the market by placing screens in new environments which made it desirable for different kinds of specialized advertisers to use the medium (i.e. athletic equipment advertising through a gym-based DOOH platform)

Key categories such as consumer electronic devices and luxury embraced the medium in key cities and developed appropriate creative assets

All of these factors should continue to support future outcomes which I think will be roughly in-line with the overall industry. If anything, the erosion of television should be particularly important to monitor as a potential catalyst to support whatever growth occurs.

While I’m doubtful that video running on DOOH platforms will capture significant television budgets any time soon, as I’ve written previously, the challenges that television faces in driving campaign reach on its existing platform is becoming substantial, especially as we approach a world where less than half of the population has a pay TV subscription of any kind, and where ad-free streaming services continue to dominate. This means that most large advertisers will need to seriously rethink what their media objectives are. For an example, I expect growing numbers will be questioning whether reach should be a primary metric to manage against, and if it is, whether or not it gets define across media or whether or not video campaign reach needs to include more than just professionally produced television.

If outdoor advertising vendors have a compelling case to capture a growing share of budgets from any given advertiser, the opportunity going forward will more likely look better than it was in the pre-pandemic past.

(1) While Lamar, Outfront and JC Decaux all disclose organic revenue growth, Clear Channel does not. However, their acquired revenue is relatively small, and so does not materially impact the numbers calculated here.